The NPV method provides a criterion for whether or not a project is a good project. It does not always provide a good solution when a company must make a choice between several acceptable projects because funds are not available to pursue them all. Computing the NPV and IRR of a project to determine which project(s) among many others to undertake is not always as easy and straightforward as it seems. The IRR and NPV can, in fact, produce different ranking outcomes whenever mutually exclusive projects are involved. If the net present value of a project or investment is negative, then it is not worth undertaking, as it will be worth less in the future than it is today. If, on the other hand, an investor could earn 8% with no risk over the next year, then the offer of $105 in a year would not suffice.

Positive NPV

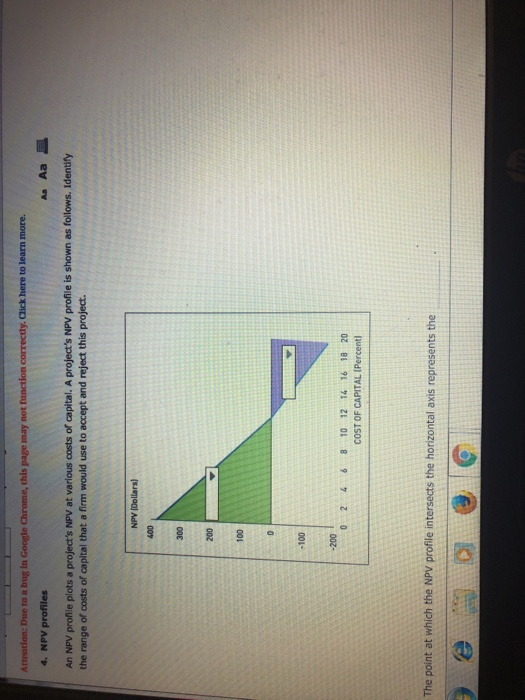

NPV profile of a project or investment is a graph of the project’s net present value corresponding to different values of discount rates. The NPV values are plotted on the Y-axis and the WACC is plotted on the X-axis. Meanwhile, today’s dollar can be invested in a safe asset like government bonds; investments riskier than Treasuries must offer a higher rate of return.

Investment Appraisal

A zero NPV implies that the investment or project will neither generate a net gain nor a net loss in value. In this situation, decision-makers should carefully weigh the risks and potential what is a simple tax return benefits of the investment or project before making a decision. The NPV formula doesn’t evaluate a project’s return on investment (ROI), a key consideration for anyone with finite capital.

Applying NPV Profile Analysis

IRR is usually more useful when you are comparing across multiple projects or investments, or in situations where it is difficult to determine the appropriate discount rate. NPV tends to be better for when cash flows may flip from positive to negative (or back again) over time, or when there are multiple discount rates. If the NPV profile remains above the x-axis across all discount rates, it indicates that the project is expected to generate positive net present values regardless of the discount rate. To do this, the firm estimates the future cash flows of the project and discounts them into present value amounts using a discount rate that represents the project’s cost of capital and its risk.

- So, JKL Media’s project has a positive NPV, but from a business perspective, the firm should also know what rate of return will be generated by this investment.

- In summary, NPV profile analysis provides a dynamic view of investment projects, allowing decision-makers to assess risks, uncertainties, and potential rewards.

- Another situation that causes problems for people who prefer the IRR method is when the discount rate of a project is not known.

- A zero NPV implies that the investment or project will neither generate a net gain nor a net loss in value.

- However, what if an investor could choose to receive $100 today or $105 in one year?

Shorter payback periods are generally more attractive, as they indicate faster recovery of the initial investment. To construct an NPV profile for Sam’s, select several discount rates and compute the NPV for the embroidery machine project using each of those discount rates. Notice that if the discount rate is zero, the NPV is simply the sum of the cash flows. As the discount rate becomes larger, the NPV falls and eventually becomes negative. The NPV (Net Present Value) Profile is a graphical representation that depicts the relationship between the NPV of a project and the discount rate used in the NPV calculation. It provides a visual tool for analyzing and comparing the financial viability of different investment projects.

This holistic assessment allows decision-makers to strike a delicate balance between risk and reward. Let’s say you have a project that requires initial investment of $10 million and will generate net cash flows of $3.5 million in each of the next 5 years. If we want to see how sensitive the project’s net present value is to the discount rate, we need to find NPV values for different discount rates say 4%, 8%, 12%, 16% and 20%.

All of the cash flows are discounted back to their present value to be compared. Projects with a positive NPV should be accepted, and projects with a negative NPV should be rejected. Third, the discount rate used to discount future cash flows to the present can be increased or decreased to adjust for the riskiness of the project’s cash flows. NPV is a financial metric that measures the value of a project or investment by comparing the present value of its expected cash inflows to the present value of its outflows. It helps determine whether a particular project is expected to generate positive or negative returns. The NPV is the difference between the present value of expected cash inflows and outflows over the project’s life.

Poor corporate governance can also cause a company to ignore or miscalculate NPV. The net present value rule is the idea that company managers and investors should only invest in projects or engage in transactions that have a positive net present value (NPV). They should avoid investing in projects that have a negative net present value.

One of the primary advantages of NPV is its consideration of the time value of money, which ensures that cash flows are appropriately adjusted for their timing and value. By comparing NPVs, decision-makers can identify the most attractive investment opportunities and allocate resources accordingly. Remember, the net Present Value profile is a powerful tool that aids in decision-making by providing a comprehensive understanding of an investment project’s financial prospects. Although most companies follow the net present value rule, there are circumstances where it is not a factor. For example, a company with significant debt issues may abandon or postpone undertaking a project with a positive NPV. The company may take the opposite direction as it redirects capital to resolve an immediately pressing debt issue.

If the profile lies above the x-axis, the project is expected to generate positive net present value and is considered financially viable. Conversely, if the profile is below the x-axis, the project is expected to result in negative NPV and may not be economically feasible. They react to changes in input variables—be it cash flows, discount rates, or project timelines. Sensitivity analysis, often conducted alongside NPV profiling, sheds light on the robustness of investment decisions. In summary, NPV provides a rigorous framework for evaluating investment projects.

If the NPV is positive, it indicates that the investment is expected to generate more cash flows than the initial investment and is therefore a good investment. If the NPV is negative, it indicates that the investment is not expected to generate enough cash flows to cover the initial investment and is therefore a bad investment. Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project.