The Available Balance will reflect this pending transaction, reducing the amount of funds you can access until the transaction is completed. In contrast, the Account Balance will not be affected by the pending transaction until it is fully processed. what is the difference between account balance and available balance For example, your bank account balance can be $1,500, but your available balance may only be $1,000. The available balance consists of the funds that you can withdraw immediately, including through debit card purchases or ATM withdrawals.

Contact us for personalized assistance

- When in doubt, check your available balance to know what you can spend, but keep an eye out for future automatic payments or other transactions that could cause your account to overdraft.

- To distinguish between the two, think of your available and current balance in the same way you would your net and gross earnings from your paycheck.

- Using the available balance instead of the current balance can help reduce the chance of overdrawing your account, which could trigger overdraft fees and possibly NSF fees.

Your available balance can give you a better idea of what money you have to spend. To view important disclosures about the Experian Smart Money™ Digital Checking Account & Debit Card, visit experian.com/legal. By accessing the noted link you will be leaving the Stanford Federal Credit Union website and entering a website hosted by another party. Although Stanford FCU has approved this as a reliable partner site, Stanford FCU takes no responsibility for the content on the website.

ways to get a free bank account

So if you rely on subscription services or automatic bill pay, make sure to track when those payments are due so you don’t spend your available balance right before subscriptions renew. When looking at the available balance vs. the current balance, both are reliable ways to help manage your finances. If you’re trying to budget for the long term, then using the current balance may be more helpful. This will help give you an overview of how much is in your account once everything processes, especially outstanding payments. Using the available balance instead of the current balance can help reduce the chance of overdrawing your account, which could trigger overdraft fees and possibly NSF fees. Depending on the type of deposit, the length of time the hold lasts can vary.

Reasons the available balance and current balance don’t match up

That said, if your current balance and available balance are different, you’ll want to note both, especially if you have upcoming transactions like direct deposits or unprocessed checks. One of the primary distinctions between Account Balance and Available Balance is the treatment of pending transactions. The Account Balance does not consider pending transactions, while the Available Balance takes them into account. Pending transactions include any transactions that have been initiated but have not yet been fully processed by the bank. Bank apps, text alerts, and websites can be helpful ways to monitor your finances in real time and help you avoid expensive fees. Learn about the best checking accounts to see how they stack up against your current bank’s offerings.

Are you a member of Stanford Federal Credit Union?

That way, you can keep on top of all the different payments going in and out of your account. You should consult your individual tax or legal professional before taking any action that may have tax or legal consequences. All users of our online services are subject to our Privacy Statement and agree to be bound by the Terms of Service.

Your available balance and current balance help you properly track your finances for savings and checking accounts. The available balance shows how much you could withdraw immediately, and the current balance represents your funds after pending transactions. Monitoring both of these can help you make more accurate financial choices. Your current balance is the amount of money in your account at the moment. It reflects all deposits, withdrawals, and purchases the bank has processed.

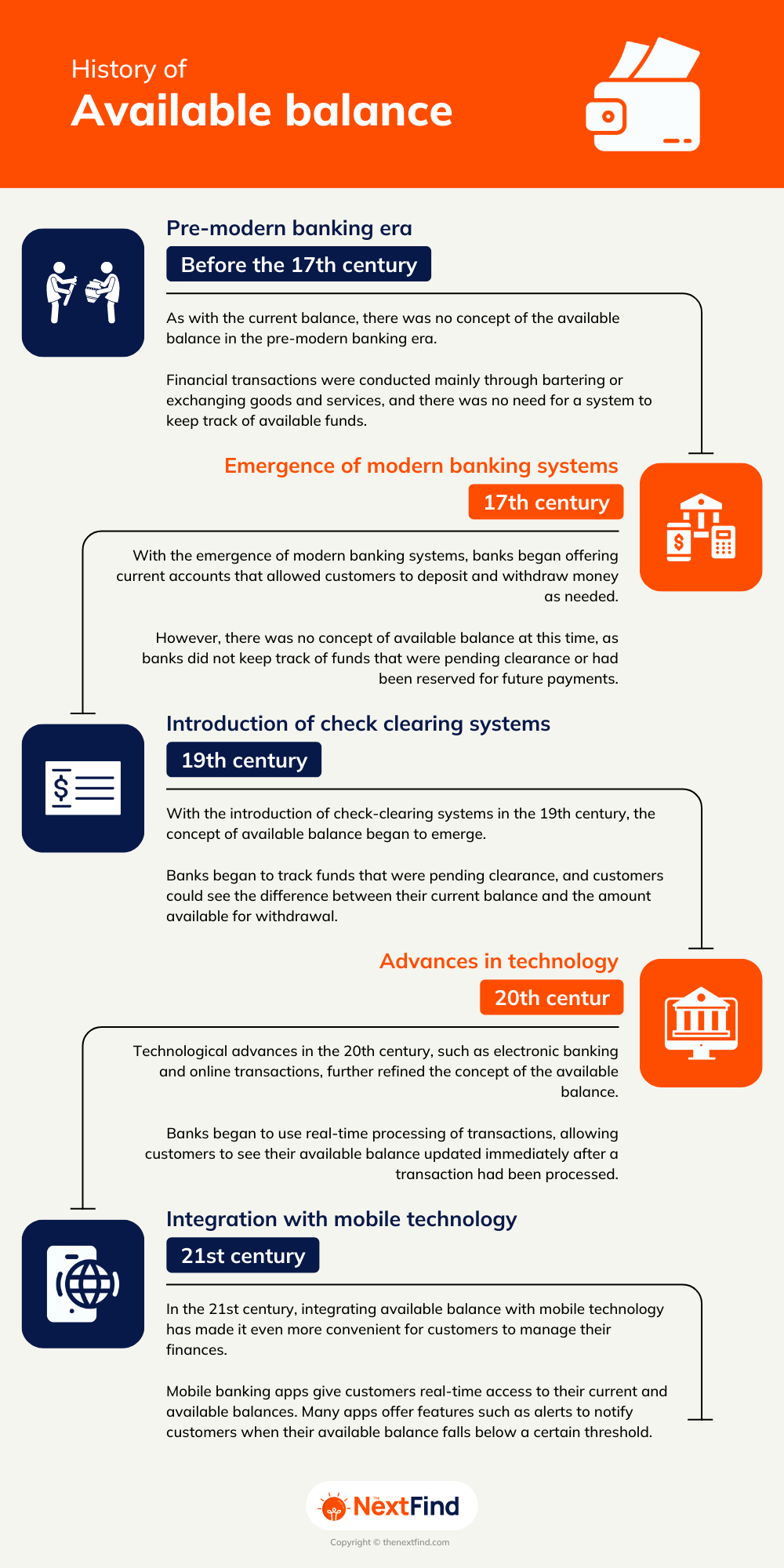

In the financial world, money in a checking account is the equivalent of cash. A customer’s available balance becomes important when there is a delay in crediting funds to an account. If an issuing bank has not cleared a check deposit, for example, the funds will not be available to the account holder, even though they may show up in the account’s current balance. A pending debit card transaction is a recent one that hasn’t yet cleared or been taken from your account. Debit card transactions can take several days to go through and will show as pending until then.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. While your present balance would still be $2,000, your available balance—or how much you can actually spend—would be $550 because it accounts for those pending transactions. As mentioned above, the reflected amount between the two sometimes varies due to pending transactions that haven’t yet been posted. While both balances show the funds in your account, knowing the difference between your current balance and available balance can help you make informed decisions about your budget. Here are a few of the spending habits that may cause a difference between your available balance and current balance.

This means that the Account Balance may not accurately represent the actual funds you can access at any given time. Knowing where millionaires keep their money can teach us how to manage our own wealth. In general, checking your available balance is the best way to know exactly how much is in your account at any given moment. Doing so can also help you avoid a cash crunch and prevent account overdrafts and fees. If you used a paper check yesterday, it may not have passed through the bank yet.